One of the main discoveries of 2021. One of the most sustainable projects on the market. We analyze Terra (LUNA) in this review. Cast a glance at the most recent review and discover all the top-notch tactics to use for trading the LUNA coin and generating profits.

| Official Website | https://www.terra.money/ |

| Launched in | 2014 |

| Disbursement | Medium |

| Liquidity | Medium |

| License | Open-source |

| Original author | Do Kwon and Daniel Sheen |

| Active hosts | 130 |

| Limits | No limits |

| Private Transactions | No |

| Public vs. Private | Public |

LUNA: Key Facts

South Korea’s e-commerce platform TMON (Ticket Monster) initiated the establishment of Terraform Labs (Terra) in 2018. CEO (and co-owner of LUNA and Terra) – Do Kwon (former Microsoft and Apple engineer and CEO of Anyfi).

The Terra Alliance includes 15 large e-commerce companies that collectively process transactions for 45 million users in the amount of $25 billion annually.

The total investment in the project amounted to $50-100 million, and now, thanks to the increased capitalization of over $10 billion and the distribution of tokens mainly in its favour, Terra has a billion-dollar budget for strategic development.

What Is Vertcoin Coin?

LUNA is the Terra blockchain token. It is used as fuel for transactions and participates in the issuance of TerraUSD (UST) and other fiat tokens. Users stake LUNA cryptocurrency and receive a reward similar to mining.

The platform was created by Terraform Labs to decentralize the financial sector: issuing stablecoins, deposits and loans and creating synthetic assets. The goal of the team is a global payment network with low fees without the barriers that create national borders.

How Vertcoin Coin Works

Network consensus is achieved by the Tendermint BFT (Byzantine Fault Tolerance) mechanism. There are 130 validators, and they have the largest amount of stake and, accordingly, the power of the vote.

To successfully validate transactions and include them in a block, ⅔ nodes must be consistent. When trying to sign false transactions, being offline for a long time, or voting dishonestly, the node is penalized and excluded from the process.

In return for their work (server maintenance), validators are rewarded with LUNA coins. Ordinary users can also join the process and earn income by delegating their stake. So, Terra works without errors and forms a true order in a decentralized blockchain.

By the principle of operation, the Terra blockchain is similar to Ethereum 2.0 (including its EIP-1559 update because part of the MOON from commissions is also burned).

Starting as a platform for an analogue of dollars – UST, Terra is growing into a large ecosystem with services in all popular categories.

Stablecoins

Stablecoins are similar to DAI on the Ethereum network. Tokens are issued, equal in price to the US dollar, Korean won and other assets. This is achieved through overfunding. The user stakes their LUNAs and starts printing digital dollars.

Usually, there are more LUNA coins than dollars, and this allows you to maintain the price of the UST token, for example, at the level of $1. If there are fewer LUNA coins, those who stake it at times that are unprofitable for the algorithm will receive an increased reward when the balance is restored.

Synthetic Assets

A protocol for creating synthetic assets representing some value in the Terra network. Oracles receive information from the open web every 30 seconds and synchronize it with the price in the engine. For example, Apple shares.

As in the situation with the above algorithm for stablecoins, a stable price is achieved due to excess collateral. The issuer must place a minimum of 150% in the balance of the LUNA contract, and 50% will be a “cushion” to keep the exchange rate of Apple tokens in the Terra network at an appropriate level.

Loans

Exchanges for deposits in dollar stablecoins or native tokens. It is possible to borrow and give at an average of 10% and 25% per annum, respectively.

Social Networks

With rewards for content creators in the form of tokens, a referral program and decentralized statehood (users can vote on proposals and contribute their ideas).

IDO

They post new projects for presale in the Initial DEX Offering format. When instead of selling tokens directly at a fixed price, the buyer can get them only by staking another, more valuable token (for example, LUNA). And gradually begin to receive profitability in the form of a startup token with a certain fixed or floating interest rate.

NFT

Marketplaces are virtual markets where digital art objects and other non-fungible tokens (Non-Fungible Tokens) are put up for sale.

Source: coinmarketcap

Pros of Vertcoin

The total supply is 1 billion. But the issue is not limited: this number can be exceeded. If there are more than 1 billion Terra units in circulation, they will begin to be burned to restore balance. New coins are generated or destroyed by an algorithm called seigniorage as needed. The goal is to maintain the exchange rate of stablecoins.

In October 2021, the volume of circulating supply was 400+ mln.

Security

Management assets are not supported by anything. The price of stablecoins is linked to the value of fiat, but at the same time, they also do not have classical collateral in the form of foreign exchange accounts or gold reserves. Stablecoins are created by burning an equivalent number of Lunas. This approach not only offers a new way to issue stablecoins but also provides a hedging tool:

- If the price of the management coin decreases against the dollar, then the user will be able to buy more Luna with UST.

- If the rate increases, then more TerraUSD will be issued.

Given the small deviation and rapid stabilization of prices for the stablecoins of the system, the proposed mechanism can be called reliable.

Usage

The developers have provided 2 main functions:

- Validator awards.

- Participation in management.

Users can influence the development of the system by putting forward, accepting or rejecting proposals. In this case, 1 coin = 1 vote. It can be delegated to validators. General scheme of the control process:

- The user makes an offer. To start voting, you need to deposit at least 512 coins into it. This can be done not only by the creator of the proposal but also by all participants in the ecosystem. This measure serves as protection against spam.

- When the deposit is made, a two-week voting period will begin. Answers are provided: for, against, veto, abstain.

- The votes are being counted. For the proposal to be accepted, 3 conditions must be met: at least 40% of the supplied coins participated in the vote, less than 33.4% expressed a veto, and more than 50% voted positively.

- The accepted proposals are being implemented. All deposits are returned regardless of the decision. The exception is those who vetoed.

If the number of those who chose NoWithVeto is more than 33.4%, the proposal will be rejected with a ban on implementation. The deposits of such users are destroyed. The mechanism prevents abuse in the system.

Vertcoin in Numbers

- Market Cap: $157,843,282

- Circulating Supply: 127,475,474 LUNA

- Total Supply: 1,004,262,701 LUNA

- Trading Volume 24h: $44,490,032

- Volume / Market Cap: 0.2818

- Market Dominance: 0.02%

- Market Rank: #127

How Can I Obtain Vertcoin?

Users cannot add new units of cryptocurrency through mining on GPU or ASIC devices. After all, the network works on the PoS algorithm. But other ways are available to investors:

- Buying on the stock exchanges.

- Private deal.

Exchange Trading

Cryptocurrency is presented on 30+ platforms. Popular: Binance, KuCoin, Huobi Global, OKEx, Crypto.com Exchange. You can also trade through the decentralized TerraSwap protocol. It allows the exchange of platform native tokens and CW20 standard assets. Another popular option from developers is Loop finance, which provides access to a decentralized exchange.

Buy Vertcoin

The list of exchangers through which you can buy a crypto coin for fiat is still limited in the fall of 2021. For example, with QIWI, it will be possible to transfer rubles only through 2 rating sites: Obmen Money and BankomatOrg. And with PayPal – only through ExChaner, Exchange24. But as blockchain startup becomes popular, there will be more and more services.

This way of buying is less reliable than trading through exchanges. In addition, exchangers charge high commissions and often do not offer the most favourable rate.

By personal agreement, you can exchange rubles, euros or other fiat currency for a crypto coin. This can be done through special sites or forums by finding a seller with suitable conditions. The main disadvantage is the high risk of getting scammed.

How to Buy Vertcoin?

All operations are carried out thanks to the project blockchain. It works on the Proof-of-Stake (PoS) mechanism. The network uses the Cosmos toolkit and the Tendermint consensus verification system:

- A validator is selected. It will validate the block.

- All nodes try to reach a consensus. To do this, they vote on whether the new chain link is accepted or rejected. The process is divided into 2 rounds. Each validator has a copy of all transactions performed on the network, which it compares with the proposed block.

- If the link is rejected, a new validator will be selected. The process will repeat.

- When everything is correct, the new block is signed and added to the chain.

- The transaction fees are shared between the validator and the users who have delegated their coins to it. The node that confirmed the block receives additional profit.

- The process is repeated but with a different validator. New blocks are added to the chain.

Fees

Regardless of the size of the transaction, validators receive a commission from 0.1 to 1 SDR (special drawing right: 1 SDR in October 2021 was equivalent to $1.4109).

Transaction speed

The protocol has high scalability and throughput. In 2021, the current rate is 1,000 TPS. Given that the network is powered by the Tendermint consensus and uses the Cosmos SDK, the highest possible is 10,000 TPS. The creators commented that, if necessary, they could connect another parallel circuit. On average, it takes ≈ 6 seconds to process an operation.

What Can Vertcoin Do?

Terra’s calculations are based on the LUNA cryptocurrency. It also serves as collateral for stablecoins. There are several stablecoins on the network – based on the euro, Korean won and US dollar. The latter – the dollar – is the most famous and bears the ticker UST.

Using special algorithms, Terra allows you to keep a stablecoin rate – at least in theory. When the value of UST does not match the value of the real US dollar, algorithms use LUNA to induce people to take certain actions in the market to stabilize the exchange rate, as well as burn existing stocks of UST or print new ones.

True, there are a few red flags:

- The US SEC frowns on Terraform’s activities;

- Algorithmic stablecoins have performed poorly in other ecosystems.

The most famous example is the collapse of the algorithmic stable Titan – the coin went from $ 64 to $ 0, caused damage to investors by $ 1+ billion, and among the victims was the cryptocurrency advocate and NBA main character Mark Cuban.

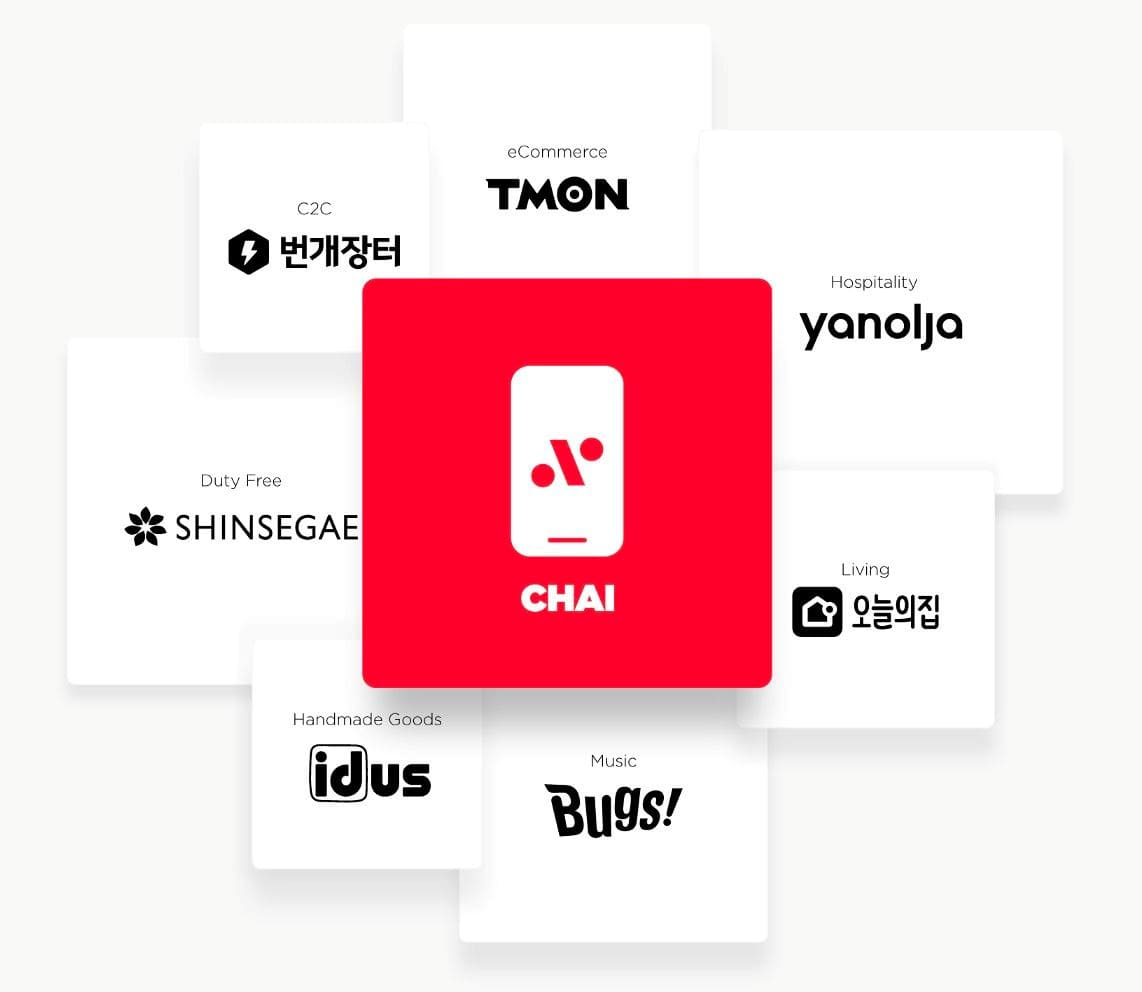

CHAI

CHAI is a key service of the payment system. According to the developers, it is used by 5% of the population of South Korea. Mobile application for money transfers in Korean Won. Available on the App Store and Google Play.

It is easy to pay for purchases and receive various discounts from partners. Besides Chaya, there are dozens of other systems. This is Terra’s main specialization – to offer stablecoins and an inexpensive blockchain so that products can be built on it.

A floating commission from 0.1% to 1% goes to the developer fund for development.

LUNA Staking

Anyone can put their LUNA and receive from the network a yield of about 4-6% per annum.

Own node will bring higher reward (1-2% more), but only the top 130 delegates participate in the consensus. This will require 20 thousand LUNA coins and computing power in the form of servers.

What Products Work on Terra?

The main users are decentralized payment services and liquidity protocols. Terra has built cryptocurrency transports with Ethereum and Binance Smart Chain networks (Terra Bridge, Shuttle, Wormhole).

The Kash banking app uses Intellarbridge, which opens banking 3.0 to a mass audience, giving them access to Mirror and Anchor in a simplified shell.

Anyone can collateralize (issue) stablecoins and other assets using LUNA as fuel and collateral. For example, a third-world country would like to create a payment system for the population with a more reliable international currency instead of a national one in order to get its economy out of the pressure of the emerging banking system.

Or, issue a national stablecoin and provide the public with a secure blockchain with low commissions for transfers without the participation of the vulnerable server infrastructure of private banks.

The Latest News About Vertcoin

There is no official roadmap, as proposals to change the protocol are made, accepted or rejected by coin holders. But the main directions of development in 2021-2023 are:

- Launch and popularization of Astroport – DEX in the project ecosystem with the support of an automatic market maker. This is the next-generation AMM with its own native ASRTA token.

- Issuance of new stablecoins.

- Interaction with a large number of blockchains through TerraBridge.

- Increase the number of protocols up to 15 pieces.

A digital asset is a promising investment because its price has all the prerequisites to grow to $100 within 1-5 years. The project is constantly evolving thanks to the proposals of the holders. New protocols are being created, promising tools for earning are emerging, and the number of stablecoins is growing.

Vertcoin Trading Tactics

In the review of the LUNA crypto coin from the developers, the following ways of generating income are considered:

- Investing in protocols.

Staking

The user can act as a validator that validates transactions and generates new blocks. But the list of active nodes is limited: the maximum is 130. They are ranked by the number of coins in the account.

Anyone can become a node if they create a validator, register a profile, and send a create-validator transaction to the network.

But this way of earning is suitable only for holders of a large number of coins. Ordinary users can delegate their coins to the selected validator and make a profit. Rewards come from two sources:

- Gas fee. These are fees added to transactions that take place on the network. Validators set a minimum gas fee and reject transactions below this threshold. This is necessary to avoid spam.

- Fees for maintaining network stability. Fees are imposed on each transaction. There are 2 taxes: Tobin tax for stablecoin exchange and Spread fee for management coin.

Transaction fees are shared between validators and their delegates. The size of the reward is commensurate with their rates.

The average annual return on staking for delegates is 10-11%. Rewards are paid in different stablecoins + Luna. There is no minimum entry threshold. The shortest blocking period is 21 days.

The advantage for stakers is that they automatically participate in airdrops when new protocols are launched.

Investments

Compared to the minimum price by October 2021, the rate of the crypto coin has increased by 37,000%. According to CoinMarketCap, ROI (investment prospects) is estimated at 2,500%+. These are high figures that indicate that the price of cryptocurrency can rise significantly.

Trading

Spot trading is available on 30+ exchanges. This is the simplest type of transaction. Also, 12 platforms allow trading with leverage: OKEx, BitFinex, Binance, and Poloniex. Given the volatility of the asset, traders can make a profit by buying altcoin at a drawdown and selling at the peak of the price increase.

Earnings through protocols

The project includes a whole ecosystem of interconnected platforms operating based on the Terra blockchain. And each offers its own conditions for earning:

- The Anchor protocol provides holders of the UST stablecoin with an income of 20% per annum.

- People can invest in MIR tokens or use the functionality of the Mirror platform through the Station Plugin to invest. The depositor provides a collateral obligation and receives mAssets assets – that is, tokenized shares of Tesla, Amazon and other large companies. Stacking option available.

LUNA Fundamentals: Key Factors

In fact, Terra (LUNA) is not just a cryptocurrency but an entire ecosystem. You can compare it with BSC or Ethereum, where there are many applications and various tokens.

Something similar to Terra there is: it combines several cryptocurrencies and services that work together, ensuring mutual stability. After all, as you know, the digital asset market is not stable. However, like the traditional market.

The price of Terra coins is stable as they are pegged to fiat currencies. But the management coin is highly volatile, and its rate is affected by:

- Bitcoin price change.

- Development of blockchain projects that issue stablecoins: USDT (Tether), USDC (Coinbase), BUSD (Binance), USDP (Paxex), and GUSD (Gemini exchanges of the Winklevoss brothers).

- The general mood in the cryptocurrency market: bullish or bearish.

- Change of interest in stablecoins issued on the platform.

- Launch of new platforms and protocols that are part of the Terra ecosystem, the introduction of tools for earning.

- Improved interoperability with other blockchains through TerraBridge.

- Network updates. Especially those that increase throughput.

- Publications in social networks and news.

- Support for large institutional investors.

Thus, Terra is a blockchain with its own cryptocurrency, a set of stablecoins and services working together for the stability of the exchange rate. The chain is represented in the larger Cosmos ecosystem.

FAQ

What changes the price of a cryptocurrency?

Since Luna acts as collateral for stablecoins, any changes in demand for these coins significantly affect the rate.

What is slashing?

This is a penalty for the incorrect behaviour of the validator. Reasons for slashing: double signature of the same block, unavailability for a certain period, incorrect voting.

Where is the project more popular?

Most of the major investors and partners are located in the Asia-Pacific region.

What new payment solutions has the blockchain project introduced?

Automatic balancing of the number of stablecoins depending on the interest and demand of investors. I also introduced a management coin that eliminates price fluctuations.