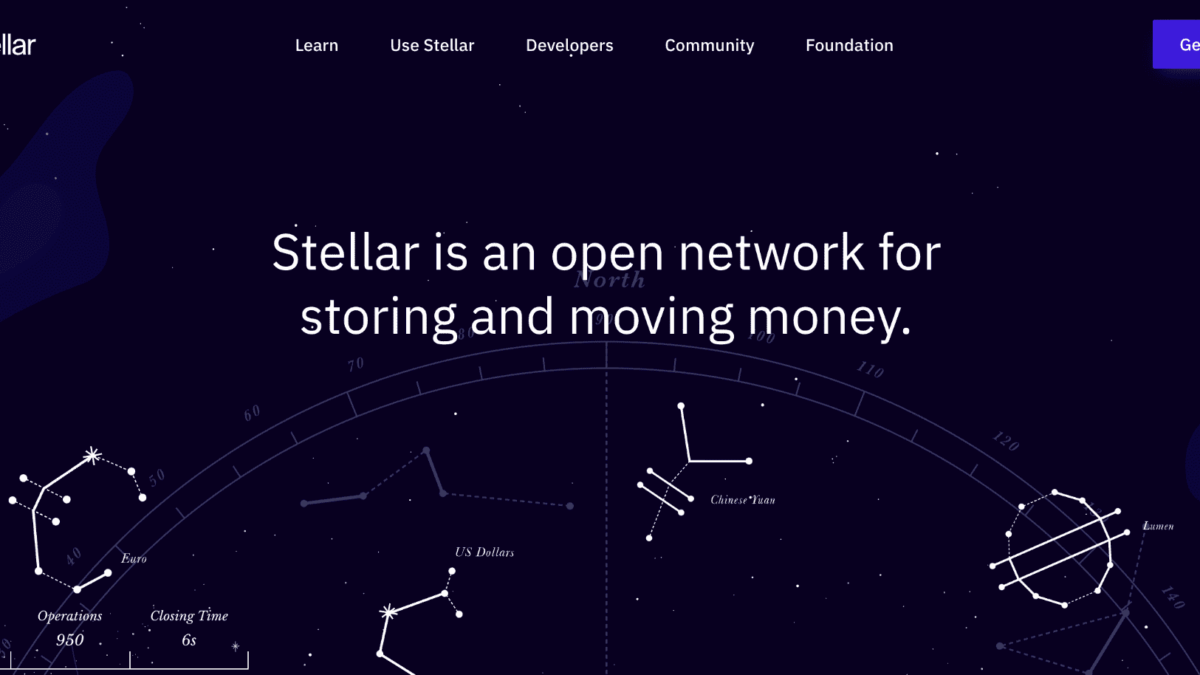

The foreign exchange market can be transformed thanks to blockchain technology entirely. The Stellar project made it possible to trade in tokenised forms of fiat money, assets, and united financial organisations from different countries.

After reading a detailed review of the Stellar (XLM) cryptocurrency, potential investors can evaluate the platform’s and the coin’s prospects.

| Official Website | https://stellar.org/ |

| Launched in | 2014 |

| Disbursement | Medium |

| Liquidity | Medium |

| License | Open-source |

| Original author | Jed McCaleb Joyce Kim |

| Active hosts | 130 |

| Limits | 50,001,806,812 XLM |

| Private Transactions | No |

| Public vs. Private | Public |

Stellar: Key Facts

In 2014, the decentralised Stellar system was launched with its Lumens cryptocurrency. It was conceived as a platform for creating, storing and transparently exchanging money.

It is positioned not as a replacement for the existing financial system but as a tool for modification (by reducing costs and time for making cross-border transfers).

Until 2015, Stellar was a fork of Ripple. That is, it appeared due to the fork of the blockchain.

The platform quickly became Ripple’s main competitor. Both projects aim at the same market – money transfers – but at the same time, they radically differ in ideas and methods of implementation.

The confrontation between Ripple and Stellar is not accidental. The leading developer of both blockchain projects is the same – Jed McCaleb. Background:

- In 2011, the programmer started creating a decentralised payment network that does not need a mining process to conduct transactions. And so, an updated version of Ripple was created.

- Jed worked at the company until 2013 and then left due to fundamental differences in the vision of the project development. He criticised the high centralisation of the network and the focus not on individuals but on payment systems, banks and corporations.

- In 2014, with his girlfriend Joyce Kim, he launched the startup Stellar on the Ripple protocol.

The new blockchain project was supposed to use the original network’s technical capabilities but, at the same time, make it more decentralized and solve its main problems:

| Claims Against Ripple In 2013-2014 That Led To The Fork | Postulates In Stellar |

| The network was supported by a limited number of validators. All of them were part of the commercial firm Ripple Labs. | The non-profit organization Stellar Development Foundation is engaged in the development and support of the blockchain project. The creators cannot profit from the sale of shares or the operation of the network. |

| The company’s management includes former bankers and financiers. | Providing convenient payment options to residents of developing countries, small businesses, private investors and non-profit organizations. |

| In 2014, all system tokens were owned by Ripple Labs. Then they were distributed among the employees of the company, and not all investors. | The number of coins to be created was immediately agreed, as well as the amount to be generated every week to maintain artificial inflation (in 2019, the last paragraph was canceled). |

| Until 2013, the code was still closed; there was a centralized control. | The code was immediately opened. |

| Focus on banks and corporations | Only 5% go to the Development Foundation (for operating activities. 2% was bought in advance by Stripe). The Fund reports on the work done every quarter.Most coins are distributed free of charge:25% are credited to non-profit organisations. Users receive 50% in portions. 20% goes to Bitcoin holders. Coins generated from transaction fees will be redistributed free of charge. |

Significant events in the history of a startup:

- In 2015, D. Kim reported finding problems in the protocol. Therefore, a new code was developed from scratch – Stellar-Core, which used a different consensus principle (SCP).

The project is no longer a fork of Ripple.

- In October 2017, an agreement was signed with IBM on using blockchain for cross-border payments. The opening of multi-currency corridors was announced, facilitating transfers in the South Pacific region.

- In December 2017, the token was listed on the primary exchange OKEx.

- In May 2018, the coin appeared on the Bitfinex cryptocurrency platform.

- In June 2018, the project received a certificate confirming its compliance with Sharia law.

- In August 2018, IBM launched Blockchain World Wire on the Stellar protocol, which enabled financial institutions to conduct cross-border transfers and clearing. 97% of the world’s central banks could use the new instruments. Advantages: transparent and cheap transactions, increased security, easy payment method, and performance.

- In September 2018, the launch of the first DEX (Decentralized Managed Exchange) was announced, which supports fiat and sets 0% fees.

- In November 2018, the largest airdrop of $125 million was announced. According to the program, within 20 months, each coin holder could receive up to $500 in XLM cryptocurrency. But the promotion ended prematurely in December 2019. This happened due to the emergence of numerous fake/duplicate accounts.

- In February 2019, central Canadian crypto platform Coinsquare bought out DEX.

- In October 2019, the protocol update was completed. A significant change is the elimination of the mechanism of artificial inflation.

- In December 2020, crypto platform Coinsquare sold DEX to Ultra Stellar, a software development company.

What Is Stellar Coin?

Stellar is a peer-to-peer network consisting of nodes (computers) that maintain a distributed ledger and exchange information to confirm and add transactions. This type of consensus was created as a result of the Federated Byzantine Agreement (FDA) development.

The coin is at the heart of a decentralized blockchain platform that has implemented the option of asset tokenization. The user can digitise any value (by creating their stablecoin) and then sell/buy it. Coins can be pegged to fiat currencies (euro, ruble, yuan), precious metals, stocks and other assets.

Well-known examples of stablecoins generated on other platforms: Tether pegged USDT to the dollar and Coinbase pegged to USDC.

Example: A user can create a digital representation of EUR, naming it a Euro token. Its price is 1 to 1 to fiat currency, backed by an equivalent deposit. Then you can make transactions in tokens as with traditional money. But the advantage lies in simple, fast cross-border transactions.

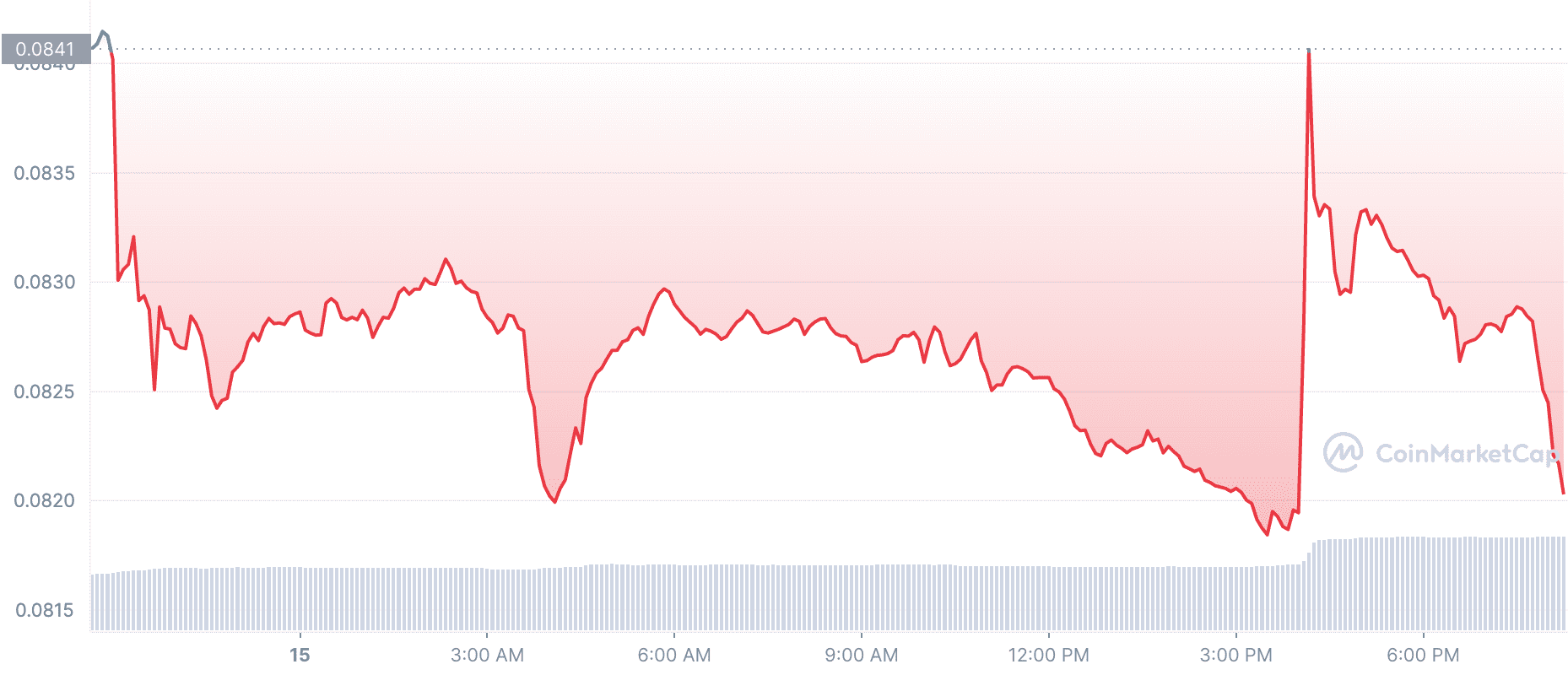

Source: CoinMarketCap

The platform does not give privileges to any tokens. It has Stellar cryptocurrency – lumens. But their only feature is that they must make transfers and open an account. The minimum balance is 1 XLM. And the minuscule transfer fee is 0.00001 units.

The blockchain platform acts as a decentralised system for currency transactions. Let’s say a user needs to send rubles from a Sberbank account to the balance of the Bank of England, converting them into pounds sterling in the process (that is, making a transfer + exchange in 1 operation). Platform process:

- The user keeps ruble tokens on the account. It tells the network to send the tokenised sterling to the recipient.

- The system has a built-in DEX, whose algorithms find the best price for the pair and fix it.

- The user confirms the operation, and the ruble tokens are debited from his account.

- The recipient is sent coins of pounds sterling.

The crypto project roadmap is based on three principles:

- Development of new tools for international operations.

- Increasing awareness.

- Maintain network reliability and security.

The developers want to increase the volume of transactions by five times, expand the ecosystem and attract more partners from the banking sector.

The project’s creators are supporters of finalizing international legislation so that any financial institutions (including state banks) can use the capabilities of the blockchain. So cooperation with the government of different countries and assistance in changing their regulatory framework is planned.

Stellar Enterprise Fund (a venture capital fund for developing the open-source network) will host one new event per quarter. The goal is to popularize the altcoin and services.

How Stellar Works

Key properties of the coin include:

- Decentralized control.

- Low latency. That is, the nodes quickly reach a consensus.

- Asymptotic safety. The network is secure as digital signatures, and a series of hashes are used, adjusting the parameters. Analogy: the number of characters in a password increases as the power of the attacker increases.

- Flexible trust. Example: A small non-profit firm can play a crucial role in maintaining the integrity of much larger organizations. That is, users can trust any combination of parties they see fit.

All nodes perform essential functions: they run Stellar Core, connect to peer computers, conduct transactions, store information about the state of the registry in the SQL database, and create data duplicates. In addition, a node can:

- Participate in reaching consensus (to validate transactions).

- Publish an archive that other computers will access for complete information about the network’s history.

Pros of Stellar

Coin Features

- The network allows you to tokenize any assets (from fiat currencies to gold or shares) and conduct transactions with them.

- Although initially, the Stellar crypt was positioned as a “people’s coin”, it was its network that large corporations and banks began to use (one of the significant agreements was concluded with IBM).

- Given the low price of tokens and the minimum transaction fees, the currency is suitable for quickly transferring funds between different accounts or exchanges.

- The platform is open source, and published on Github.

Stellar Technology

The network is multifunctional: in addition to conducting exchange operations, users can develop smart contracts, deploy decentralised DApps, and conduct initial coin offerings (ICOs). In addition, a decentralized exchange is built into the platform (i.e., increased security of transactions is provided). The following tools were developed as part of the project:

- Applications and wallets for storing and sending assets. Solar Wallet stands out with its multi-signature support option. Lobstr is a wallet with the ability to recover the key.

- For trading on the DEX, you can use StellarX, StellarPort, and Stellarterm. The platform has an open-source trading bot.

Issue of the coin

Initially, 100 billion lumens was produced. Until 2019, additional coins were generated weekly to maintain artificial inflation (1%). Then the platform policy changed, and the creation of new tokens was stopped. There was also a “burning” of coins.

Security

Although the network specialises in stablecoin trading, and the coin is not pegged to fiat currency or other assets. Gold, precious metals, or stocks do not back it. But the relative stability of the exchange rate is supported by the development and expansion of the functionality of the decentralised network, the creation of new DApps, services, and the conclusion of agreements with large companies and corporations.

Cons of Stellar

There are no evident disadvantages of the coin.

Stellar in Numbers

- Market Cap: $2,133,589,905

- Fully Diluted Market Cap: $4,097,714,887

- Circulating Supply: 26,056,904,772 XLM

- Max Supply: 50,001,806,812

- Trading Volume 24h: $69,841,990

- Volume / Market Cap:0.03276

- Market Dominance: 0.25%

- Market Rank: #26

How Can I Obtain Stellar Coin?

Stellar Mining

Mining tokens are not provided. But coins can be:

- Get from another user.

- Buy through exchanges.

- Get in the free distribution of altcoins.

Purchase on the exchange or through the exchanger

The coin is traded on most major CEX marketplaces and DEX within the platform. Examples: Coinbase, Kraken, Binance, Bittrex, Huobi. Users can buy coins through a third-party exchange site. But this way is riskier.

Transfer from a private person

There are special groups in messengers where you can agree on purchasing a specific number of tokens for any fiat or cryptocurrency. But then the user takes all the risks.

Participate in Airdrop

The network periodically conducts a free distribution of tokens. The last time you could get up to $500 in Stellar coins.

Airdrop is an effective marketing technique with the free distribution of altcoins. It is designed to increase the popularity of the crypto project.

How to Buy Stellar Coin?

The coin has not yet received such widespread distribution as bitcoin or Ethereum, so it will not be possible to purchase it using an online exchanger. But it is presented on many popular crypto exchanges, including Binance and OKEx.

It will not be possible to buy Lumens on these sites for rubles or another fiat. So you will first have to exchange the national currency for bitcoin, Ethereum, litecoin or another popular crypto. With these coins, you can already replenish your balance on Binance and purchase Lumens with them.

Fees

The commission will be 0.00001 of the whole coin. At the exchange rate for July 2021, this is $0.00002688. The user can also simply exchange or transfer any tokenised assets.

Transaction Speed

A cross-border operation is carried out in seconds. 130 nodes support the network. Thanks to them, the productivity reaches ≈ 1000 tx/s. It takes about 5 seconds to send Lumens. This is a high speed, given that BTC is ≈7 tx/s.

What Can Stellar Do?

A detailed review of the Stellar crypto coin shows the following areas of its application:

- Instant transactions between users. The emphasis is on cross-border transfers.

- Convenient, fast exchange of digital assets.

- Maintaining the account on the network (you must have a minimum number of lumens on your balance).

- Payment for goods, services in online stores, and Internet services. Although their number is still limited, the growth in popularity of the coin will lead to an increase in the number of partner sites.

- Use for trading on large crypto exchanges.

The Latest News About Stellar

For the first time, the project’s cryptocurrency was listed on a crypto exchange in 2017. In the first days after the appearance on Poloniex, the coins were traded at the rate of $0.01. Less than a year later, Lumens reached its peak price – in January 2022, the coin touched the $0.788 mark. Those who managed to buy tokens immediately after the listing got rich almost 8 thousand times in a few months!

Since then, Lumens, along with the entire crypto market, has pretty much dipped, but at the time of writing, its price is quite high compared to the quotes a year ago – $0.288. Stellar Lumens consistently holds its position in the top ten cryptocurrencies by capitalization, stepping on the heels of Ripple with its 3rd place on the chart.

It turned out that non-commercial projects can bring investors quite a real profit. There are several reasons for Lumens price growth in the foreseeable and medium term:

- Useful Stellar functionality with a wide range of applications;

- High expert evaluations of the quality of the platform;

- Unique positioning in the market in the absence of competitors;

- Competent work of the Stellar Development Foundation team and developers focused on creating the most comfortable conditions for users and popularizing the platform;

- The rapid growth of the popularity of the platform among developers;

- Long-term partnerships with large companies. The main place here is occupied by IBM.

Stellar Trading Tactics

There are several ways to earn money by investing in a token: trading on stock exchanges or investing. One of the riskiest but potentially profitable methods is trading with leverage.

Trading

Cryptocurrency is unsecured, which means it is highly volatile. Traders can use this to make a profit by buying altcoins on a market drawdown and selling when the price rises. You can earn money on CEX and DEX. But on a decentralized platform, there is a limited choice of tools for trading.

Investment

The cost of the altcoin has already increased 19 times since the launch of the project. In the future, the price may rise even more. Even with cautious forecasts, XLM should hit the $1 mark and move higher. Therefore, the coin is suitable for long-term investments.

Stellar Fundamentals: Key Factors

The price of an asset depends on the following factors:

- The conclusion of partnerships with companies and corporations.

- Listing on significant cryptocurrency exchanges.

- Increasing popularity in the network and publications in the media.

- The general state of the crypto market.

- Implementation of new services and tools.

- Mystery shopping activity.

- Protocol updates.

The crypto project has long-term prospects, and the price of the coin has every reason to grow. The platform is constantly evolving:

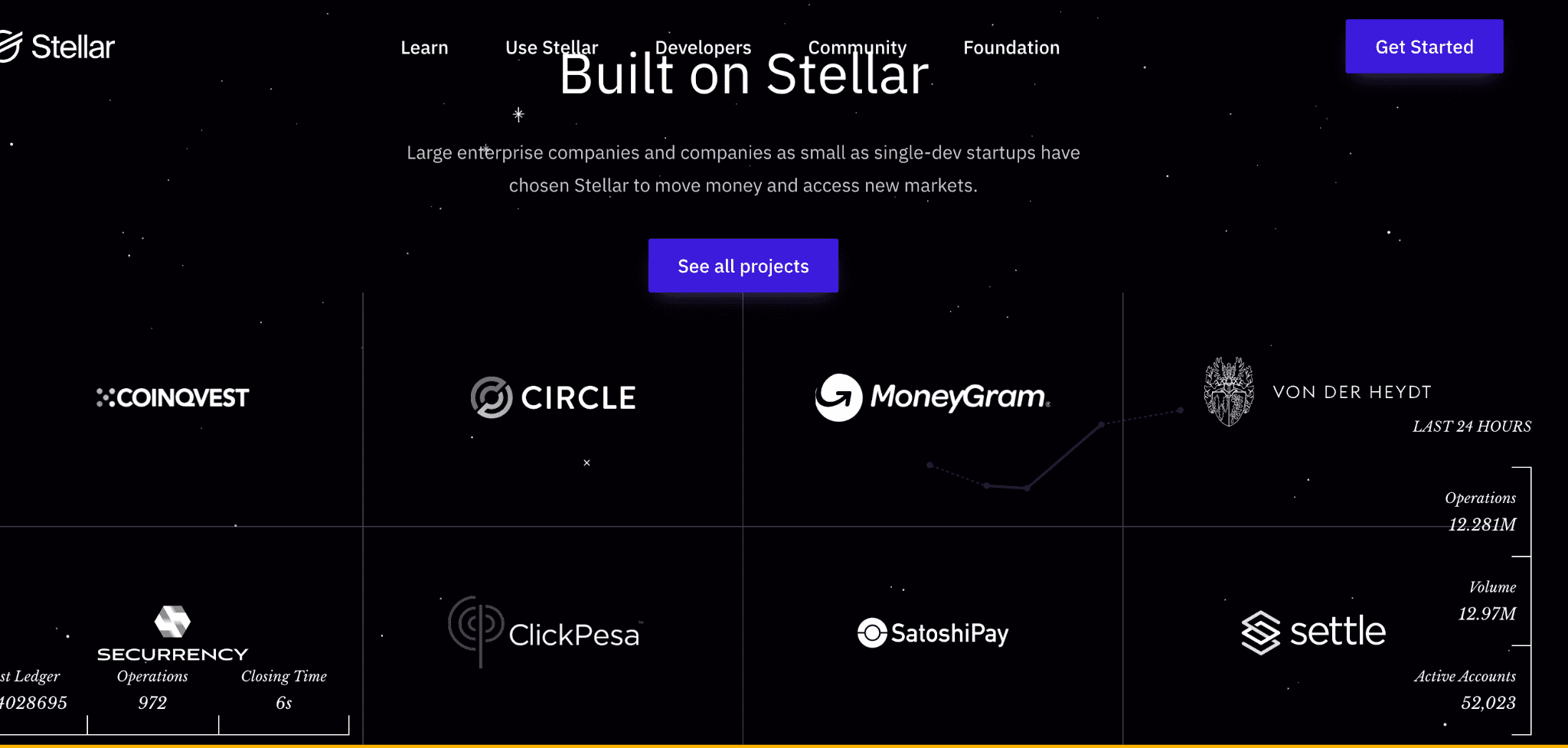

- There are more and more new stablecoins (Circle has already issued USDC, and the oldest German bank Bankhaus von der Heydt has issued EURB).

- New long-term partnerships are being created with large companies, corporations and even government agencies. The latest agreements were concluded with the Ministry of Digital Transformation of Ukraine, IBM, and the German company Vonovia, which issued bonds on the Stellar blockchain.

- The speed and volume of transactions are increasing.

- Thanks to the ability to create smart contracts and decentralized applications, the project can become a competitor to Ethereum.

- Stellar Development Foundation expands the number of developers.

FAQ

Why do I need a minimum balance of coins on my account?

This is a necessary condition designed to protect the system from creating duplicate spam accounts. To activate the account, the user must deposit 1 Lumen. Adding a new asset will require a reserve of another 0.5 coins. If a user wants to hold 3 coins, then he needs to have (1 for account initialization + (0.5 coins for reserve * 3) = 2.5 Lumens.

What is the Stellar Development Foundation?

The SDF is a non-profit, non-stock organization registered in the state of Delaware.

Why do you need a support fund?

He is engaged in the development of technologies and the Stellar network, attracts new partners, and creates and maintains the functioning of the community.

Is there any Lumen draws planned?

As of July 2021, information was published that all airdrops have so far been completed. The distribution of tokens is not planned. If it will be carried out, then only through verified partner sites (Coinbase and Keybase).

Issuance of new lumen coins stopped?

Yes, in 2021, according to official information, the creation of new tokens is not carried out and is not planned for the future.